If Your Home Was Foreclosed Due to Mortgage or Property Taxes, You May Be Owed $25,000 or More In “Surplus Funds”

STEP 1: WATCH THIS PRESENTATION

STEP 2: Check If You’re Owed Funds

STEP 2:

Check If You’re Owed Funds

“Wait… Can I Really Be Owed Money After Foreclosure?” YES!

Here’s the truth: in almost half of all foreclosure sales, the home sells for more than what you owed in property taxes or on your mortgage.

That extra money is called surplus funds. And it legally belongs to you.

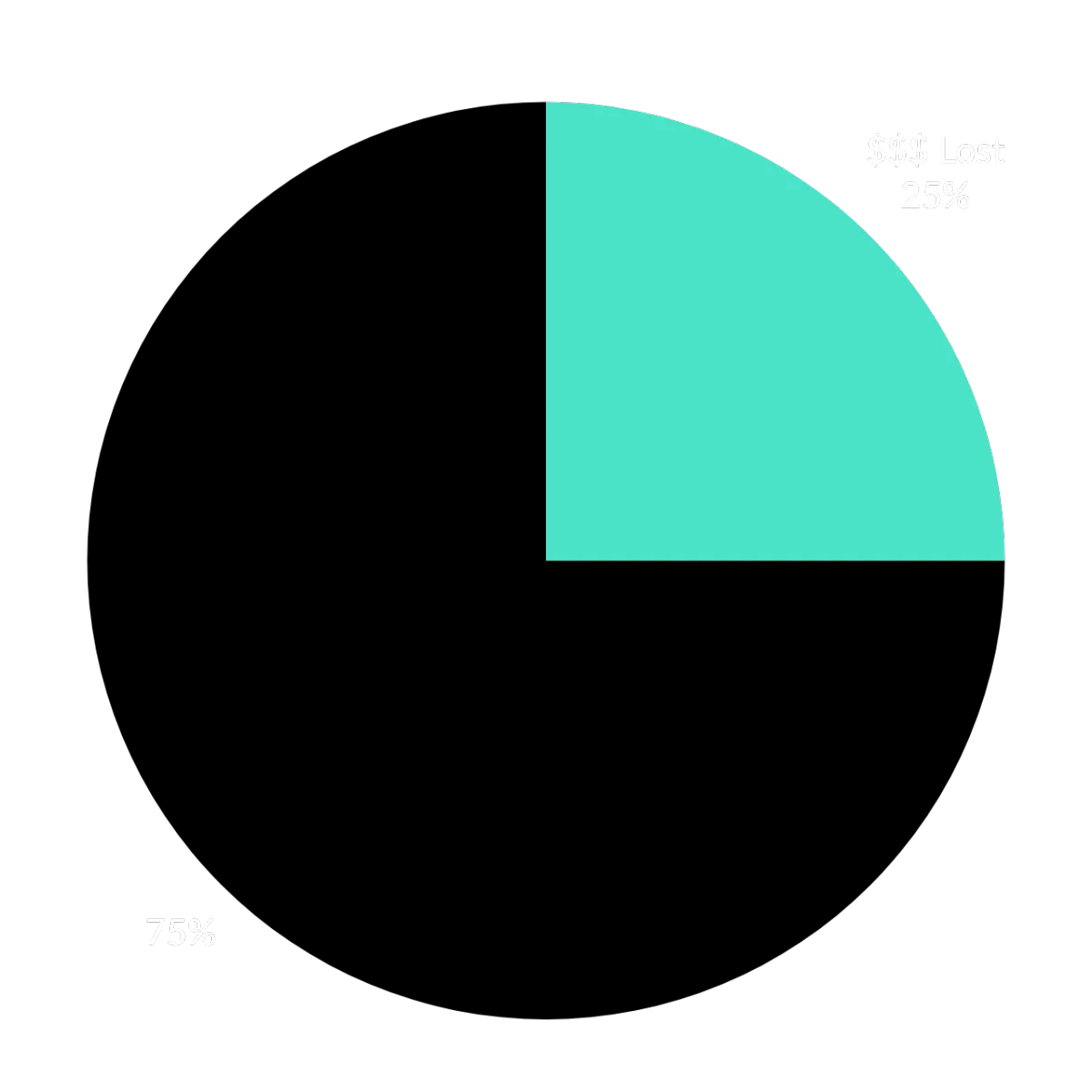

Even in cases where people thought they had no equity at all, about 2 in 6 still ended up with money left over after the sale.

In fact, the average surplus in these cases is over $30,000.

That’s tens of thousands of dollars that could be sitting unclaimed right now, with your name on it.

So if your home was foreclosed on, there’s a very real chance you're owed something, and we can find out for you.

Here’s How We Help You Recover What’s Rightfully Yours

Answer a few simple questions.

No paperwork, just basic details

We research the case. Checking county records, court filings, and official documents.

Funds are recovered and delivered. Many of our clients get their funds in about 90 days. You only pay us if funds are successfully recovered.

Here’s How We Help You Recover What’s Rightfully Yours

Answer a few simple questions.

No paperwork, just basic details.

We research the case. Checking county records, court filings, and official documents.

Funds are recovered and delivered. Many of our clients get their funds in about 90 days. You only pay us if funds are successfully recovered.

Why Homeowners Trust Us to Recover Their Surplus Funds

Typical recoveries range from $10,000 to $100,000+

Many families discover funds they never knew existed

No upfront fees

U.S.-based team handles everything start to finish

Still Have Questions?

How do I know if I’m owed anything?

Complete a free eligibility check. We’ll research county and court records to confirm if surplus funds are available.

Is this legit?

Yes. Surplus funds are governed by state law. When a property sells for more than the debt, the extra belongs to the homeowner or estate. The challenge is most people are never notified and don’t know how to claim it.

How long does it take?

Many clients see results in about 90 days, depending on the state and case details.

Don’t Let The Government Keep Your Surplus Funds

If your home was foreclosed, whether from a mortgage or property taxes, surplus funds may be waiting to be claimed by you.

There’s no cost to check, and no fees unless funds are recovered.

But deadlines apply.

Take 60 seconds now to see if you qualify.